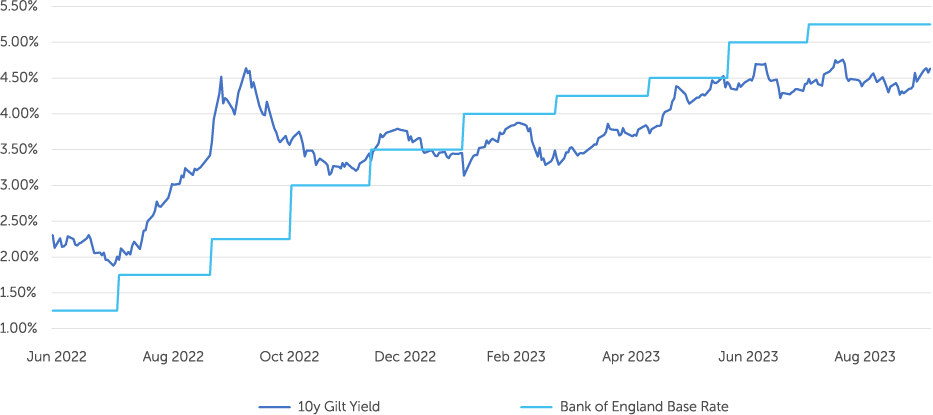

It is now over 12 months since the mini-budget that led to yields rising over 1% within a day. The Bank of England’s intervention helped to stabilise yields and bring them back in line with their global peers. LDI mandates have evolved rapidly to shore up the resilience of these portfolios should a similar spike occur in future.

Now one year on, we find ourselves in a very similar place in terms of yields but reached at in a very different way to the extreme events last year. Over 2023, on the back of rising rates, stubbornly high inflation and geopolitical events, global yields have risen steadily back to multi-year highs and UK gilts have been no exception.

10 Year Gilt Yield:

Source: FTSE, Barnett Waddingham

As a result, many schemes have seen improvements in their funding positions – particularly in deficit terms – and on the prized solvency bases. This is great news, however we’ve seen how quickly conditions can change and those deficits could easily reemerge if actions aren’t taken to lock down the position.

For those schemes that are in a better position than 12 months ago, our message is to not be complacent.

Examples of complacent positions

"I’ve reached full funding now, job done?"

Where action can be taken now to lock into the progress made towards reaching a long-term target, then our view is this should be considered and implemented while the opportunity is there.

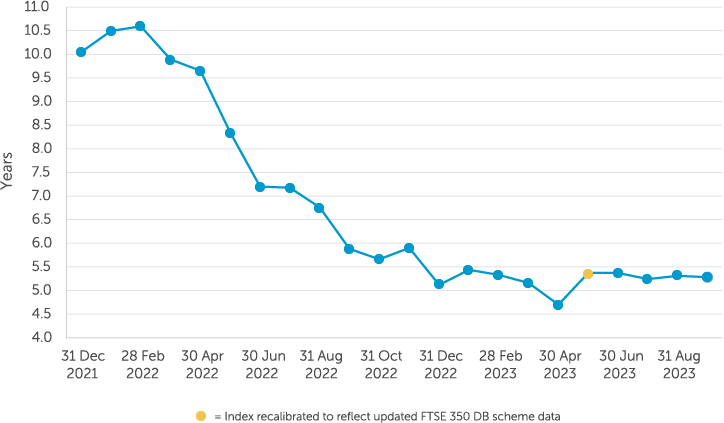

Across UK DB pension schemes, funding positions in the industry appear to be stronger because of rising yields. This is particularly true when measured on a buyout type basis. At the end of May 2023, we estimate that the average time to buyout for the FTSE 350 DB pension schemes was around five years - a reduction of over three years compared to the equivalent position in May 2022, and around half of the index's value at the start of 2022. The focus now for DB schemes is on endgame planning and ensuring they have acted to lock into funding improvements on that longer-term basis.

Barnett Waddingham End Gauge Index:

Source: Barnett Waddingham

"We don’t need any more contributions from the employer because we are now fully funded on an ‘ongoing’ basis."

We believe employers should be consulted so they understand where the scheme is at and the risks that remain, as well as the pros and cons of continuing contributions to close any remaining deficit.

Even where funding positions haven’t moved much (or even declined) it’s very possible that the deficit to buying out the scheme in £ terms will be much smaller than it has been for many years. Rather than waiting for a smaller sized pool of assets to provide returns to meet this, cash contributions can go further than previously in moving the scheme towards its long-term position.

"LDI is a much stronger tool now than it ever was. We don’t need to think about it anymore."

LDI is never going to be a ‘set and forget’ strategy even with the changes introduced. It is vital that collateral levels are monitored and managed over time, so resilience is maintained. Making sure the right arrangements, in terms of portfolio structure and LDI manager, will also help ensure the hedging can stand up to future events.

Protecting against falls in interest rates or rises in inflation remains a key part of managing risk over the longer term and leveraged LDI remains an efficient tool to use to increase hedge ratios for many schemes, especially considering the changes that have been made to bolster LDI resilience. We covered the key changes made to LDI mandates since the crisis (and what schemes should be doing to further bolster resilience) in our note earlier this year, LDI, liquidity and returns: where do we go from here?

LDI news has continued along a similar theme since our note was published. Big LDI managers have taken steps to further increase resilience of their mandates, settling on target levels of resilience that are meaningfully higher (i.e. more prudent) than the minimum levels set out by the various bodies (e.g. NCAs and the Bank of England), with additional collateral typically being called into LDI funds/portfolios if resilience falls below 300bps.

In September 2023, the BoE announced its intention to create a permanent lending facility to non-bank financial institutions in times of stress. This would include LDI funds/managers and by extension, pension schemes. The BoE has stated that eligible collateral for the loan facility would be gilts at a minimum, with other assets being assessed over time. While the details of how this works in practice are yet to be confirmed, we see this as a positive step forward as the BoE signals its immediate intent to further bolster the collateral resilience of LDI funds and pension schemes.

A key point to remember is that while LDI funds themselves have become better collateralised over the last 12 months, trustees need to be mindful of ensuring that any LDI strategy that is set up today sets aside additional cash collateral to meet potential future recapitalisation calls that may arise. We typically recommend that the collateral pool is set such that schemes can easily meet (with very little manual intervention required) calls to cover 170 basis points of yield rises. This needs to be kept in check and replenished as needed.

While resilience levels will look to become more uniform across the LDI industry, our experience with working with UK LDI managers over the past year has differed substantially and it remains very important to consider the suitability of your current LDI manager for your particular arrangements.

Final thoughts

Lots has happened in the year since the gilts crisis, with much of it working to benefit defined benefit pension schemes and their LDI portfolios. Trustees and sponsors should ensure they are not complacent about where things have ended up to now, with action being taken to make the most of the position for the long term.

For professional use only. The above is for information purposes only and should not be construed as investment/regulated advice. Please contact your Barnett Waddingham consultant if you would like to discuss any of the above topics in more detail.

Contact us for all enquiries

For more information about the independent, expert services we provide in this area, speak to our team today.

Get in touch

Investment Consulting

Investment consultant advice tailored to each pension scheme, trustee board and organisation with strategy and risk at the core.

Read more